One of the first things that a prospective buyer will look at is the financial statements for your business (3 years of profit and loss statements and a balance sheet). The buyer will use these financial statements to help assess the value of your business.

Although this is helpful for the buyer, it may not show the real value of your business because it doesn’t account for taxes, depreciation, and other one-time expenses. Accounting for this can help give your buyer a better depiction of your business’ financials and improve the overall value of your business.

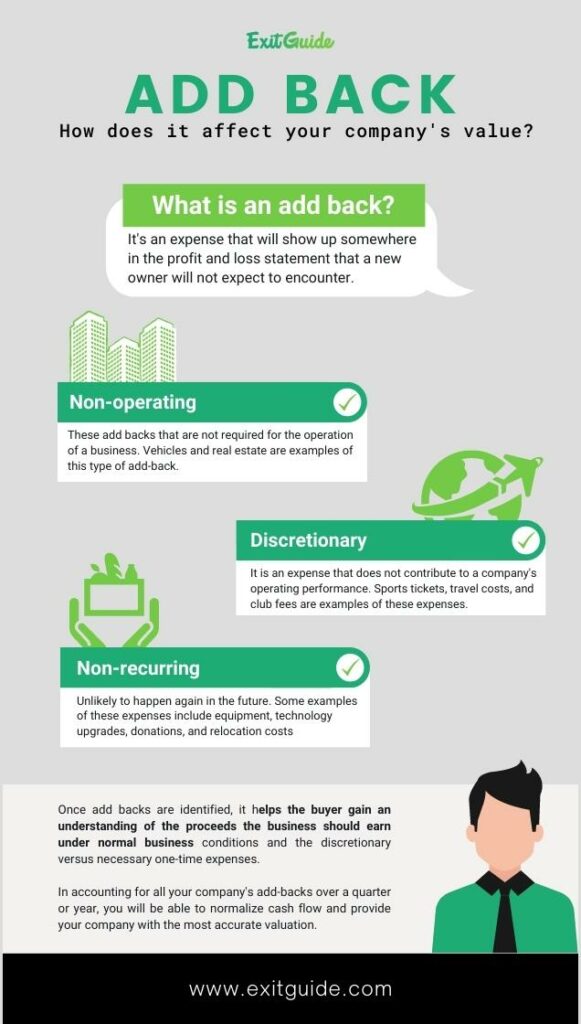

This is why it is important to understand the concept of “add-backs.” By understanding how add-backs work, you can explain how they impact your business’ valuation by accounting for some expenses.

Table of Contents

What Is An Add-back?

Add backs are expenses that are irregular, non-recurring, or discretionary and they have no long-term impact on the financials of the business and will not be included in the buyer’s future P&L statements.

These are expenses that show up somewhere in the profit and loss statement that a new owner will not expect to have once they have taken control of the business.

Importance of add-backs:

Add backs help the buyer have the most accurate picture of a business’s profits. With the discretionary, irregular, and one-off expenses identified, the buyer can see what they should expect in proceeds from a business given normal conditions and the one-time expenses that are discretionary vs necessary to run the business.

If you account for all the add-backs in your business over a quarter or calendar year, you can impact the value to your business’ valuations and this will help normalize cash flow and provide the most accurate valuation of your business.

Some of the different types of add-backs:

It is important to recognize the different types of add-backs to help you categorize your own add-backs. Some of the more common add-backs include:

- Non-operating: Non-operating add backs are that are not required for the operations of a business. Examples of this include real estate and vehicles.

- Discretionary: Discretionary add backs are expenses that do not add to the operating performance of a company. Examples of these expenses include professional sports tickets, travel fees, club fees, etc.

- Non-recurring: Non-recurring add backs are that are unlikely to occur again in the future. Examples of these types of expenses include equipment, technology upgrades, donations and relocation expenses

Additional examples of add-backs:

- Auto allowances: This can include the payments of a company or personal vehicle. You can have add backs for monthly payments, repairs and maintenance for all cars.

- Owner compensations: Owner compensations include any salary and bonuses that the owner takes from the business.

- Professional fees: Many businesses pay monthly or yearly fees for a variety of professional associations and memberships.

- Entertainment expenses: Any money spent on business-related entertainment can also be used as add backs.

- Consulting fees: Businesses use a variety of consultants for projects. You can have add backs for all the consulting fees for your business.

Consulting with a certified public accountant (CPA) when it comes to this and other accounting-related decisions is highly recommended. If you are ready to take charge of your exit, start here.