When you exit your business may be based on a target date you set years ago based on careful planning toward a financial goal. It may be driven by personal circumstances and you need to exit your business sooner than you planned.

One of the lessons learned from the COVID-19 pandemic is that the future can be uncertain; events well beyond our control can have a major impact on your life and your business. This goes both ways, when the economy is good and business is booming it may lead you to feel as though you should stay in the business.

When times are tough and business is not going too well, an exit may seem like a reprieve from the day-to-day grind. Bottom line is that your emotions can sometimes cloud your judgment.

For small business owners, there is no objective answer as to when to exit your business because it is often intertwined with your personal life. Sorry folks, this article does not contain the secret formula for sell my business at top dollar (if that exists please let us know); instead, this will outline some questions to consider when planning to sell my business.

Remember, this decision has business and personal implications. Take the time you need to think it through and consider talking to trusted advisors as well as making a list of pros and cons.

Learn what your business may be worth and how to exit your business

Table of Contents

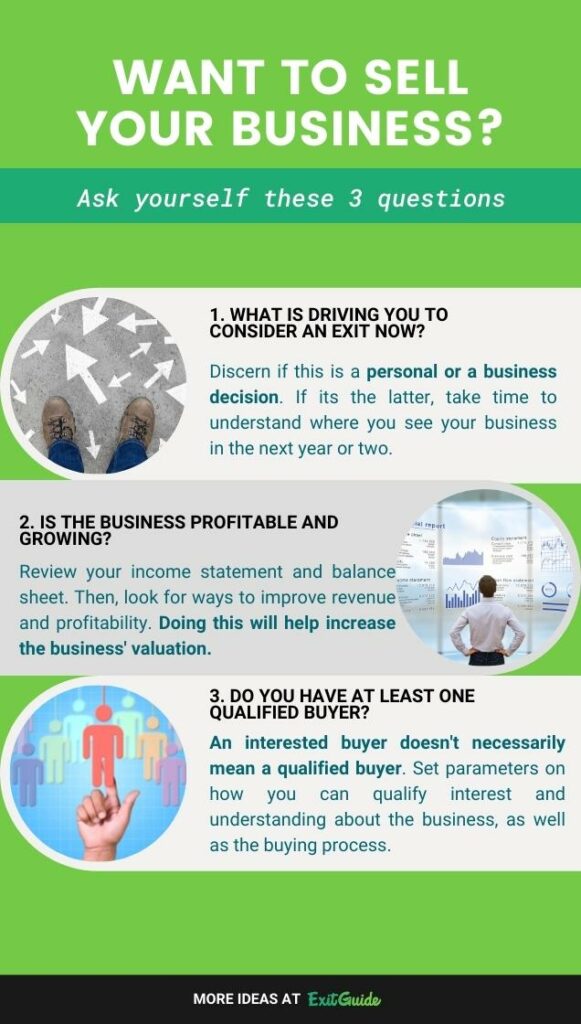

What Is Driving You To Consider An Exit Now?

The single most important question is “what is driving you to exit your business?” If it is due to personal reasons such as health, a family matter or other personal issue you need to do what is best for your own health and well being and same goes for a family or someone close to you. This may be a life decision and not a pure business decision.

If this is a business decision and you have more flexibility, you may consider taking time to understand where your business is today and where you believe it will be in the next two to three years. A mental exercise is to ask yourself, is this a “run to” or “run from” decision?

In other words, are you ‘running from’ problems in the business you have been avoiding and seeking an exit instead of addressing them? Instead, maybe you are ready for a new chapter in your life and are simply excited to move in that direction (you are ‘running to’ something new?

Much of this comes down to how much time you can (or want) to stay in the business to prepare for an exit. Timing the market is often an impossible task but getting the business to a stage that will attract prospective buyers is doable with a bit of planning and work.

Is The Business Profitable And Growing?

Do you believe you have a solid grasp of your business finances? A buyer for a small business is typically seeking a profitable business they can grow and potentially increase profitability. It is essential you take an objective look at the business starting with the financial situation.

You can start with a review of your profit and loss statement (income statement) and balance sheet. It is wise to go back at least a year or two and see if revenue (sales) is trending up, is flat or perhaps declining.

If you are serious about selling your business for more than a year, you should set clear goals to improve revenue and profitability. This is not just good for your business in general, it will help increase your business valuation. Valuations (what your business is worth) are largely based on profitability and growth.

If you optimize your business to reduce tax liabilities and maximize your take-home income, simple changes that leave more cash in the business may also help improve your valuation. Cutting back or even removing items such as car leases, memberships, and other discretionary expenses are a few examples of discretionary expenses to consider when reviewing your business finances. It is a trade-off that may payout when you exit your business.

Start your exit plan today. Take our free assessment

Do You Have At Least One Qualified Buyer Interested In The Business?

When it comes to sell my business, a bird in the hand is better than two in the bush, right? Maybe. Let’s start with an interested buyer vs a qualified buyer interested in your business. A number of people romanticize owning a business and being their own boss.

The idea does not always live up to reality. Sure there are a lot of benefits to owning and running a business. But it also comes with a lot of hard work and requires a level of perseverance to weather challenging periods.

If someone expresses interest in buying your business, do not start with price. Instead, you want to qualify their interest and understanding.

- Why are they interested in your business?

- What experience do they have as a business owner?

- Do they know your industry or bring an area of expertise that can help grow the business?

In short, does this person know what they are potentially getting into?

So what does a qualified buyer look like? Ideally, they will have the following characteristics:

- They have a clear understanding of what it means to own a business

- There is a plan in place for financing the purchase of the business

- They understand the due diligence process and ask good questions

Keep in mind, a lot of transactions are ‘seller financed’ meaning that a buyer may pay for the business using proceeds from the business after they take over as the new owner. If this is the case, it is critical they can and will operate the business effectively so they can pay the agreed-to price over a period of time.

Ready to exit your business? Start with our free assessment

The last thing you need is someone that regrets their decision a year or two into ownership of the business.

There is no perfect time to sell your business, the right time may be a combination of business and personal circumstances, and taking the time to weigh the pros and cons of your options will be a great help in coming to a decision that you can feel good about years later.